FAST FOOD FUND

Fast Food Fund

Multi Real Estate Investment Management believes that fast food properties provide a compelling investment opportunity due to their proven location and its operators. They are well-positioned for any economic outlook and aligned with evolving consumer preferences

Strategy

The fund will aggregate a portfolio of fast food properties located in the Netherlands, predominantly operated by international brands, such as McDonald’s, KFC, and Burger King

Objective

Maximise value with a regular dividend yield and potential for capital appreciation through asset management initiatives

Opportunity

Consumer preferences are changing to convenience and affordability resulting in growth of fast food sales. This trend has further strengthened due to hybrid working, continued urbanisation and technological innovation

Fast food properties are ideally positioned to capture this current trend due to its established and agile business, the ability of fast food operators to increase prices with inflation, and by leveraging technology to enhance the mostly young customer experience

Investment rationale

Inflation protection expected due to fully indexed leases, long-term lease agreements, high-quality and low-maintenance properties at proven locations, with asset management value creation opportunities

FUND DETAILS

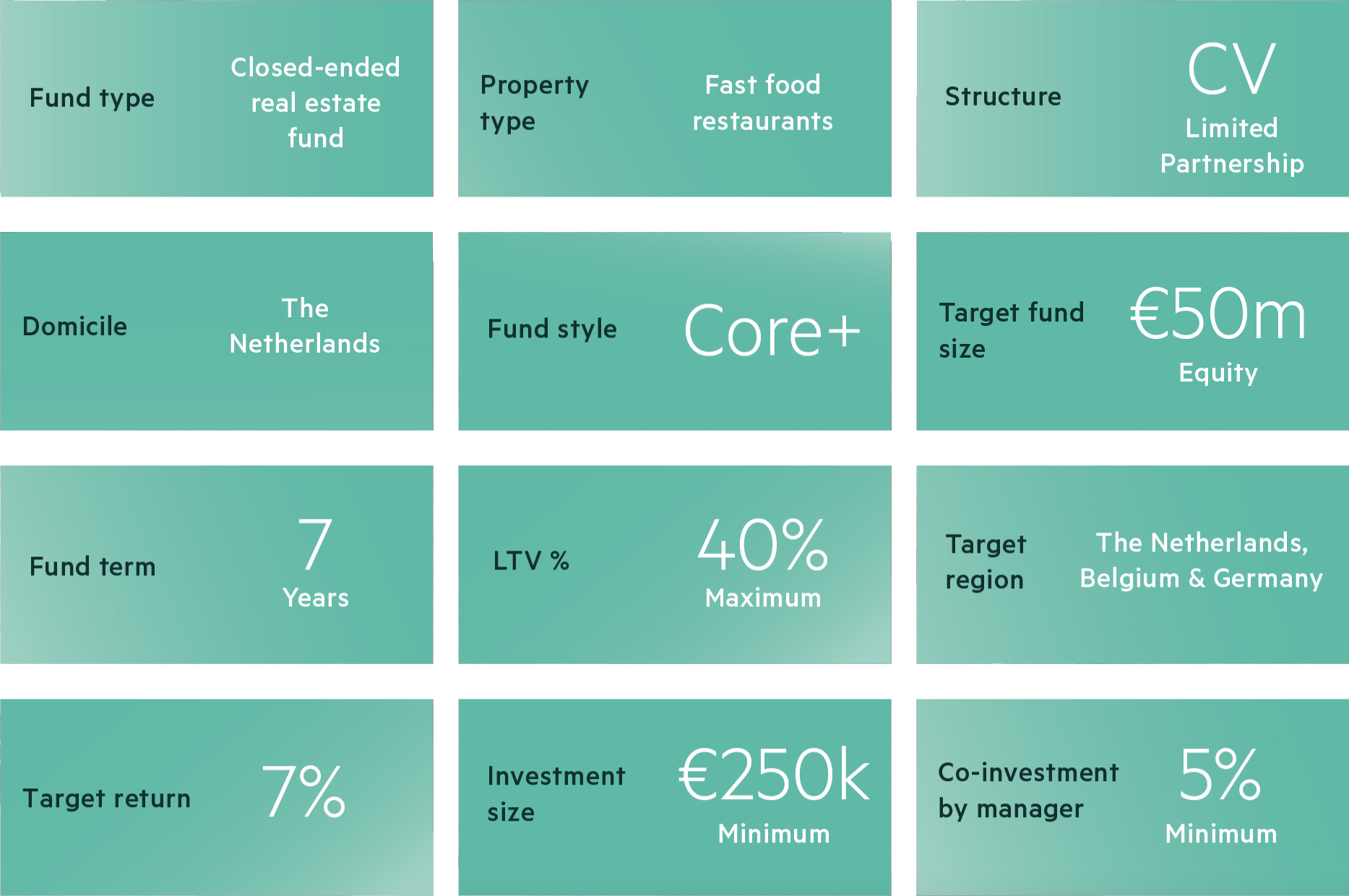

The Fund will offer a compelling investment opportunity targeting regular dividends and a 7% IRR

KEY FUN CHARACTERISTICS

- Target fund equity of € 50 million

- Investment target: 20-25 portfolio investments

- Acquisitions to take place in years 1-3 and disposition in year 7

- Management fees: 1,5% of committed capital during investment period. After, it is 1,5% over acquisition costs

- Fund leverage up to 40%

ASSUMPTION

- Entry yield range of 7%-8%

- Average inflation during hold period of ca 3% per year

- Limited vacancy during the hold period

- Exit yield range of 5%-7%

EXPECTED RETURNS

- Stabilised cash on cash 4,7%

- Fund returns 7%

- Multiple on invested capital 1,45 x

sustaınabılıty

The fund promotes climate change mitigation by investing in energy efficient fast food properties. It also promotes social characteristics by enhancement of wellbeing of people. The fund does not make any sustainable investment and no benchmark is assigned. The fund aims to have 100% of the investment aligned with the E/S characteristics. The overall long-term goal for the fund is to have:

- at least 50% of the number of properties owned to have green energy labels (meaning labels ranging from A to C) and

- AED devices installed at 100% of the properties. An AED, or automated external defibrillator, is used to help those experiencing sudden cardiac arrest. It’s a sophisticated, yet easy-to-use, medical device that can analyze the heart’s rhythm and, if necessary, deliver an electrical shock, or defibrillation, to help the heart re-establish an effective rhythm

All investment proposals contain a sustainability section, which includes the relevant ESG information, such as the availability of Energy Performance Certificates, and a climate risk assessment including energy transition and physical climate risks

To ensure continuous alignment with the environmental and social characteristics of the fund the fund manager monitors whether the investments comply with the targets set. If not met, the fund manager will take corrective measures and implements a road map that describes how the fund mitigates the issues to ensure that the fund meets the energy efficiency target and that all properties in the portfolio have AEDs installed

Engagement is not part of the environmental or social investment strategy

The metric used to calculate compliance is the share or number of investments in energy-efficient real estate assets compared to the total number of assets of the fund. The fund will use the EU-Energy Performance Certificate (EU-EPC) to calculate the energy efficiency, as basis for the assessments of the assets in the portfolio. There are no limitations to the methodologies and to the data sources used

No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have as its objective sustainable investment and does not invest in sustainable investments

Environmental or social characteristics of the financial product

The product promotes both environmental and social characteristics. More specific it promotes:

- environmental characteristics by climate change mitigation by investing in energy efficient properties

- social characteristics by enhancement of wellbeing of people by ensuring access to quality healthcare products by installing AED devices in all properties

No reference benchmark has been designated

Investment strategy

The fund invests in fast food real estate. At least 50% of the real estate needs to have a green energy label (A through C) and we ensure that we install AED devices at 100% of the real estate

No good governance is assessed because the fund does not invest in investee companies but only directly in fast food real estate properties

Proportion of investments

All investments are direct investments in real estate properties and are aligned with the environmental characteristics of the product. That means that 100% is aligned with the E/S characteristics, 0% is invested in sustainable investments

Monitoring of environmental or social characteristics

To ensure continuous alignment with the environmental and social characteristics of the fund the fund manager monitors whether the investments comply with the E/S characteristics. If not, the fund manager will take corrective measures and implements a road map that describes how the fund mitigates the issues to ensure that the fund meets the energy efficiency target and that all properties in the portfolio have AEDs installed

Methodologies

The fund uses the following sustainability indicator to measure whether the promoted environmental characteristics are met:

- 50% of the properties owned by the fund need to be energy efficient, which means that 50% of the properties need to have an energy label below C

- the installation of AED devices at 100% of the assets

Data sources and processing

The fund takes sustainability factors into account in investment decisions by measuring the exposure to energy-efficient real estate assets. The metric used is the share or number of investments in energy-efficient real estate assets compared to the total number of assets of the fund. The fund will use the EU-Energy Performance Certificate (EU-EPC) to calculate the energy efficiency, as basis for the assessments of the assets in the portfolio

As an EPC is mandatory when real estate is put up for sale, it will be available when making the investment decision. If the seller does not have an EPC, despite the law, it is easily obtainable through engagement of an energy adviser. The energy adviser will assess the real estate asset on-site and will calculate and record the energy performance. Data quality is assured by using energy advisors (this is mandatory). None of the data used will need to be estimated

With regards to properties being equipped with AED devices we will maintain a simple administration to ensure compliance

Limitations to methodologies and data

There are no limitations to the methodologies of gathering data. As there are no limitations there is no impact on how the environmental or social characteristics promoted by the financial product are being met

Due diligence

All investment proposals contain a sustainability section, which includes the relevant ESG information, such as the availability of technical measures and a climate risk assessment including transition and physical climate risks

An ESG paragraph is included in the investment proposal, which includes:

- Comparison with target (50% A-C labels and 100% AED installed)

- If the asset does not comply with the set targets, additional measures will be taken

If investing in an asset would result in the fund not meeting the targets set or if the asset itself does not comply with the targets set, the measures that need to be taken to comply, including budget and time required to mitigate, will have to be described in the investment proposal

Multi REIM recognizes that risk management is a key element in the investment process. The Management Board is responsible for ensuring investment risks are identified and mitigated if needed, and that the investment process is complied with

As a member of the Management Board, the Risk Officer (Chief Financial Risk Officer or CFRO) is a member of the Investment Committee to participate in Investor Committee meetings, where investment opportunities are presented and discussed. During these meetings, the Risk Officer verifies whether the risks are properly addressed and monitors if the investment process is complied with and as such also that the sustainability targets are being met

Moreover, to ensure continuous alignment with the environmental and social characteristics of the fund the fund manager monitors whether the investments comply with the E/S characteristics. If not, the fund manager will take corrective measures and implements a road map that describes how the fund mitigates the issues to ensure that the fund meets the energy efficiency target and that all properties in the portfolio have AEDs installed

Engagement policies

Engagement is not part of the environmental or social investment strategy

SFDR 8 Disclosure

The fund is an SFDR article 8 fund. It promotes environmental & social characteristics